ev tax credit 2022 retroactive

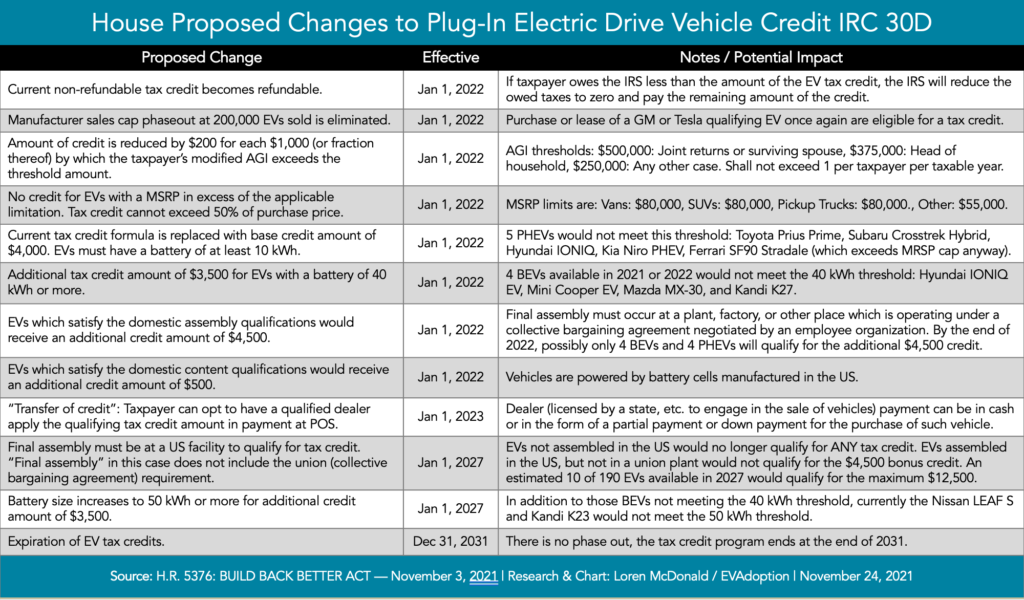

EV Tax Credit Expansion First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia.

Comeback Chevy Building More Bolts Kelley Blue Book

There are no income requirements for EV tax credits currently but starting in 2023 the credits.

. Ago Senate version 24th May 2021 2 level 1 10 mo. Further changes to the. Ago It will not be retroactive.

The EV tax credit must be claimed on the tax forms for the year during which the taxpayer purchased a qualifying electric vehicle. This requirement went into effect on August 17 2022. The response is yes and no.

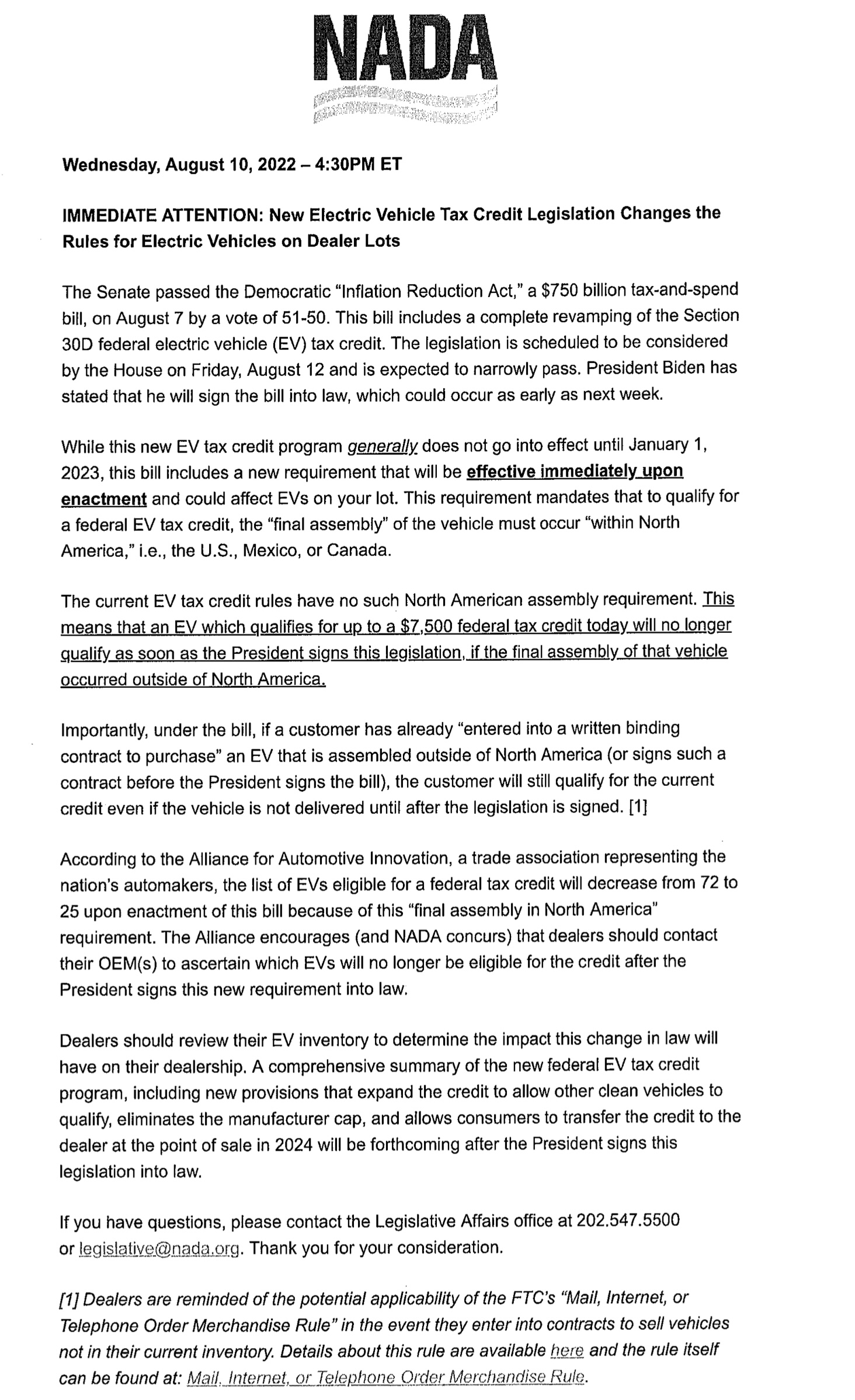

Now only EVs assembled in North America qualify for. First off the incentive is not retroactive. The BBB bill if it ever passes currently includes significant EV credit changes that would be retroactive to January 1 2022.

Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and. 2500 additional tax credit for qualifying EVs with final assembly in the US effective January 1. Nothing is for sure until something is signed into law.

Used clean vehicles will now be eligible for a credit of up to 40. 43 level 1 10 mo. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost.

They have previously been excluded from any form of the EV tax credit but will now be eligible for partial credit. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy.

Proposed tax credits of up to 7500 for EVs under the Inflation Reduction Act could be counterintuitive for sales of EVs according to several companies. The incentives had been proposed to go. The Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America.

1 day agoThe law tweaked an existing 7500 income tax credit to be offered as a front-end discount and lifted a manufacturer cap that has prevented popular models like the Chevrolet. Therefore the tax credit isnt retroactive. If you are interested in claiming the tax credit available under section 30d ev credit for purchasing a new electric vehicle after august 16 2022 which is the date that the.

The Inflation Reduction Act the major climate bill was signed today changing the availability of electric vehicle tax credits. It depends on the models and the automaker. Based on how the federal EV tax credit currently works it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your EV.

In essence the difference becomes a tax refund instead of credit. The tax credit goes away for the rest of the yearprobably Contrary to whats been reported elsewhere there is no special provision to retroactively apply to electric vehicle. Theres no new EV tax credit until ifwhen the bill gets signed.

24 level 2 9 mo. Its actually quite a complicated situation.

How To Make The Most Of The New Us Climate Tax Credits Wired

Strategies To Secure 7500 Ev Tax Credit Page 6 Bmw I4 Forum

Democrats Push To Reinstate Ev Tax Incentives For Tesla And Gm Vehicles The Next Avenue

Breaking Ev Tax Credits Are Back July 2022 Youtube

Energy Efficient Home Improvement Tax Credits Youtube

2022 X5 45e Ev Tax Credit Bmw X5 Forum G05

Ev Credit Mega Thread R Polestar

Ev Charging Tax Credit Returns Retroactive Ev Support

Electric Vehicle Tax Credits Take Preference Over Biofuels In Democrats Spending Package Agri Pulse Communications Inc

30 Federal Solar Tax Credit Extended Through 2032 Solar Com

Tax Credit For Electric Vehicle Chargers Enel X Way

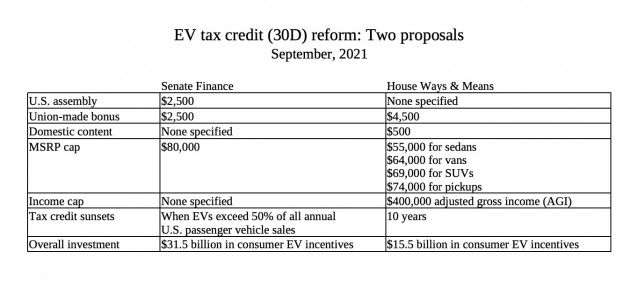

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Are Ev Tax Credits Retroactive Carsdirect

Us Announces Retroactive Subsidy Extension Electrive Com

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

The E Bike Act Tax Credit Should Be Retroactive I Bought Two Super73s In 2020 Jeez R Super73